A Quick Home Loan Preapproval Tip For Renters and Tenants.

Below is an excellent article on getting preapproved.

If you’re interested in buying a home. The article below shares some good information.

After reading this article, the one thought I have is that when you get pre-approved, you should ask your mortgage professional what is the maximum total monthly mortgage payment you cannot exceed?

This can be very helpful.

Every home you’ll look at will have a different homeowners insurance premium, different property taxes, and one property may have community dues while the other may not.

If you find a home that has low property taxes and no HOA dues, you can buy a house with a higher listing price. You will find your maximum allowed purchase price will be more if the recurring expenses are lower. In essence your maximum purchase price can increase or decrease depending on the other recurring home expenses such as HOA fees, taxes, and homeowners insurance.

Regardless of when you get pre-approved, I encourage you to contact me. I will answer the questions you currently have. I’ll also share a few more tips about getting pre-approved.

Original Source

Credible

Does Mortgage Pre-Approval Affect Your Credit Score

If you’re about to search for a new home, getting pre-approved is a good step to take. A pre-approval gives you an idea of how much you can borrow and could even grant you a competitive edge when you put in an offer.

But since the lender performs a hard inquiry during this process, the pre-approval can affect your credit score.

Here’s how getting pre-approved impacts your credit score:

- What is mortgage pre-approval?

- Why you should get pre-approved

- How getting pre-approved affects your credit

- Credible’s pre-approval process won’t hurt your credit at all

What is mortgage pre-approval?

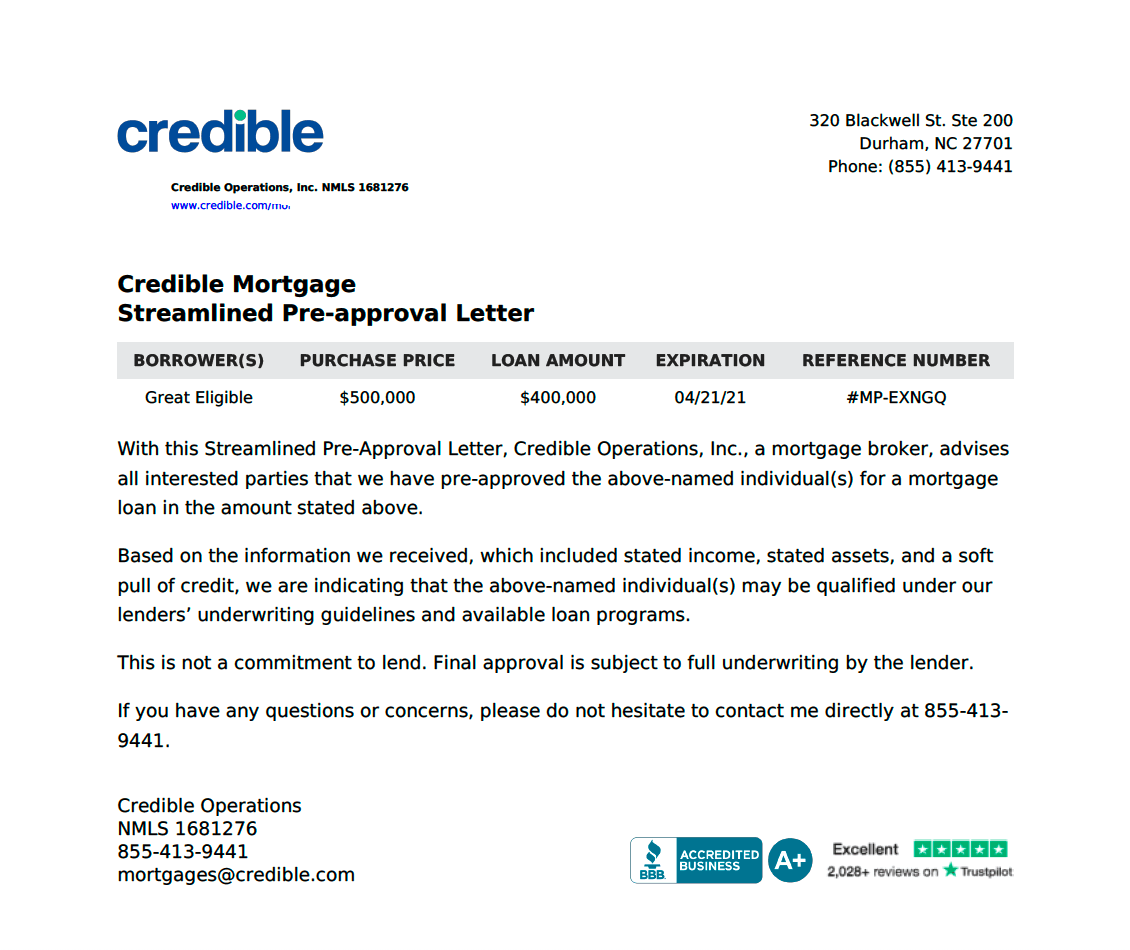

A mortgage pre-approval is a letter from a lender that estimates how much you can borrow on a home loan. The pre-approval is based on details like your income, credit history, assets, and debts.

During the process, a loan officer will go over pre-approval documents such as your credit reports, recent pay stubs, personal bank statements, and your federal personal income tax returns.

They’ll use this information to determine whether you qualify for the mortgage loan and the amount you can receive.

- While you might hear the terms pre-approval and prequalification used interchangeably, there are differences between the two:Mortgage pre-approval: Requires a more in-depth review of your finances to confirm your creditworthiness and determine the loan amount you qualify for.

- Mortgage prequalification: A lender gives you an interest rate quote based on information you tell them, usually without documentation.

Why you should get pre-approved

It’s always a good idea to get pre-approved before shopping for a home. That’s because the pre-approval process helps you:

- Set a budget: You’ll be able to establish your price range and shop for homes within your budget, which can save you time.

- Get organized: Because you’ll have a lot of the paperwork gathered for the official home loan application later, this step helps you prepare for the home buying process.

- Support your purchase offer: When you’re putting in an offer, a mortgage pre-approval letter can help you stand out from other buyers, especially in a bidding war.

- Make a financial plan: If you don’t qualify for a pre-approval, you’ll be able to find out why and create a plan to improve your finances.

How getting pre-approved affects your credit

There are many advantages of getting pre-approved, but one downside is that it can impact your credit. That’s because you give the mortgage lender permission to review your credit reports from the three main credit bureaus — Experian, TransUnion, and Equifax — and pull your credit scores.

When a person or company pulls your credit, a notation known as an inquiry appears on your credit reports. Here’s the difference between the two types of inquiries and when they can affect your credit:

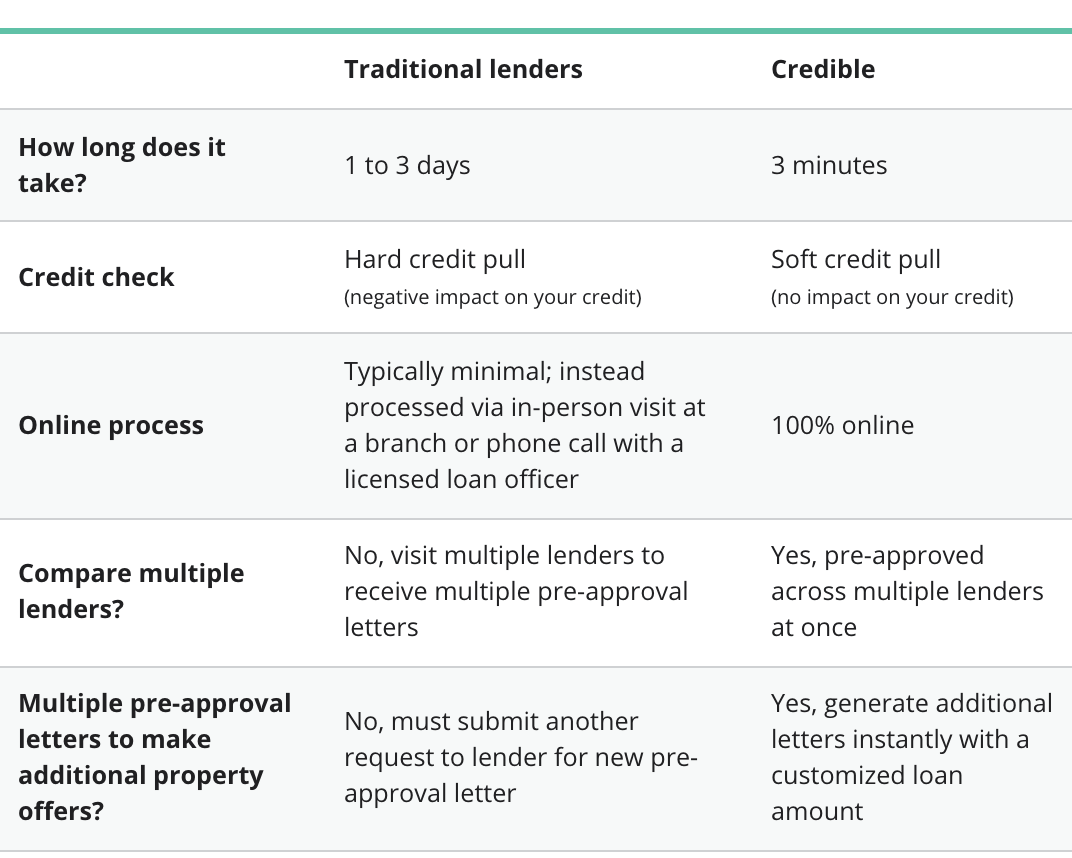

- A hard credit inquiry occurs when a lender checks your credit to make a lending decision. The inquiry will be recorded on your credit reports and may temporarily affect your credit scores because they’re associated with new debt. These usually occur with traditional mortgage pre-approvals.

- A soft credit inquiry, on the other hand, occurs when the lender only wants to provide a rate quote. Soft credit checks won’t impact your credit scores because you’re not applying for credit.

When you request personalized rates and generate a streamlined pre-approval letter from Credible, you’re authorizing a soft inquiry that has no effect on your credit score. Should you decide to move forward with a specific lender, the lender will perform a hard credit inquiry.

How much traditional pre-approvals impact your credit

According to the credit-scoring company FICO, one inquiry may lower your credit scores by up to five points, while multiple hard inquiries may have a larger impact.

And if you have a short credit history or not many accounts, an inquiry may do more damage to your score.

Tip: FICO says it considers all mortgage applications — which include pre-approvals — within a 45-day window as just one credit event. So if you complete all of your mortgage pre-approvals within this time frame, you can limit the hit to your credit.

How long your credit will be impacted by a traditional pre-approval

Hard inquiries can stay on your credit reports for up to two years, but the impact of them diminishes over time. FICO says it only considers inquiries from the last 12 months when calculating your scores.

To reduce the effects of hard inquiries, you can request pre-approvals and submit mortgage applications within a short window.

Credible’s pre-approval process won’t hurt your credit at all

Credible’s pre-approval process uses a soft credit pull, so it won’t hit your credit like a traditional mortgage pre-approval. You’ll also be able to compare home loan details from multiple lenders at once, saving you time and money.

“Here’s what to do now… download your free homebuyer ebook, click here.”

My name is Edgar DeJesus. I’m the mortgage advisor and branch manager of Treasure Coast Home Loans. Call or text, (772) 444-6362, with any questions that will let me separate opinion from opportunity.

Thank you for taking the time to read my latest real estate and mortgage report.

Start Your Mortgage Application with Treasure Coast Home Loans

Your Local Mortgage Broker

Mortgage Broker Port St. Lucie, Florida

Learn More About the Mortgage Process.

Check Out Our Google Verified Reviews