Don’t Let Faulty Wiring Shock Your Wallet: A Homebuyer’s Guide to Electrical Inspections and Insurance Protection

Imagine this scenario: You’ve just closed on your dream home, boxes are unpacked, and you’re settling into your new life. Then, barely a month later, you receive a devastating letter from your homeowners insurance company stating they’re canceling your policy due to “unacceptable electrical system conditions.” This nightmare became reality for one of my recent clients, and it’s a situation that’s becoming increasingly common in today’s housing market.

The shock of losing homeowners insurance after closing isn’t just inconvenient—it’s financially catastrophic. Without proper coverage, you’re left vulnerable to potential losses on what is likely your largest investment. More critically, most mortgage lenders require continuous insurance coverage, meaning cancellation could technically put you in default of your loan terms.

The Growing Problem of Post-Closing Insurance Cancellations

Insurance companies have become increasingly strict about electrical system requirements, particularly in older homes. With rising claims related to electrical fires and the growing complexity of modern electrical demands, insurers are conducting more thorough post-binding inspections. When they discover outdated wiring, insufficient electrical panels, or code violations that weren’t caught during the buying process, they don’t hesitate to cancel policies.

This trend has caught many homebuyers off-guard because traditional home inspections, while valuable, often don’t provide the depth of electrical analysis that insurance companies now require. The result is a gap between what buyers think they’re getting and what insurers will actually cover.

Understanding Why Electrical Systems Fail Insurance Requirements

Modern homeowners insurance companies evaluate electrical systems based on several critical factors. Age is a primary concern—many insurers automatically flag homes with electrical systems over 40 years old for additional scrutiny. Federal Pacific Electric (FPE) panels, Zinsco panels, and aluminum wiring from the 1960s and 1970s are particular red flags that can trigger immediate coverage denial.

Beyond age, insurers look for code compliance issues. Homes with insufficient grounding, outdated electrical panels that can’t handle modern electrical loads, or visible safety hazards like exposed wiring or improper installations face coverage challenges. The increasing prevalence of smart home technology, electric vehicle charging stations, and high-powered appliances has made electrical system capacity more critical than ever.

Insurance companies also consider the home’s electrical history. Previous claims related to electrical issues, evidence of DIY electrical work, or obvious safety violations discovered during their inspection process can all lead to coverage problems.

The Critical Importance of Specialized Electrical Inspections

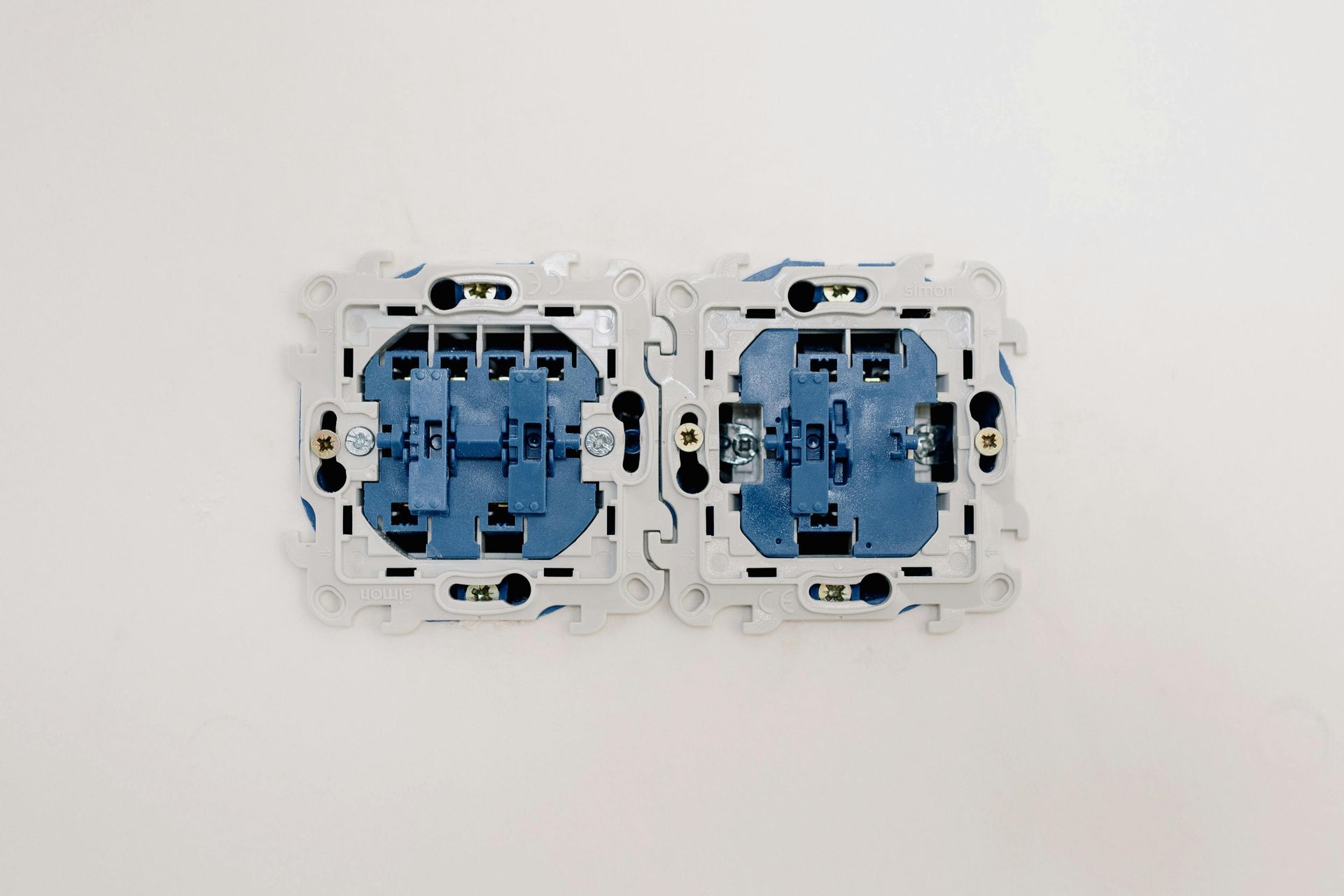

While general home inspectors provide valuable overall property assessments, they may not have the specialized electrical knowledge needed to identify all potential insurance red flags. A standard home inspection typically includes a basic electrical system check, but this surface-level review often misses the nuanced issues that concern insurance underwriters.

Hiring a licensed electrician for a dedicated electrical inspection provides several advantages. These professionals understand current electrical codes, can identify potential safety hazards that might not be immediately obvious, and can provide detailed assessments of system capacity and condition. They can also offer estimates for necessary upgrades, helping you understand the true cost of homeownership before you’re legally committed to the purchase.

An electrical specialist inspection should evaluate the main electrical panel, assess the adequacy of the home’s electrical service for modern needs, examine the condition and type of wiring throughout the house, verify proper grounding systems, check GFCI protection in required areas, and identify any code violations or safety concerns.

Strategic Timing: When to Schedule Your Electrical Inspection

The timing of your electrical inspection can make the difference between a manageable pre-closing negotiation and a post-closing crisis. Ideally, schedule your specialized electrical inspection immediately after your general home inspection, while you’re still in your due diligence period.

This timing allows you to use any discovered issues as negotiation points with the seller. Rather than facing a post-closing insurance cancellation, you can request that sellers address electrical problems before closing, negotiate credits for necessary electrical work, or adjust your offer price to account for required upgrades.

If electrical issues are discovered during your due diligence period, you have several options. You might negotiate with the seller to complete electrical upgrades before closing, request a credit at closing to handle improvements yourself, or adjust your offer to reflect the true cost of bringing the electrical system up to insurance standards.

Proactive Insurance Shopping and Communication

Don’t wait until after closing to think about homeowners insurance requirements. Begin shopping for insurance during your home search process, and be transparent about the property’s age and any known electrical concerns. This early communication can help you identify potential coverage issues before you’re committed to the purchase.

When speaking with insurance agents, ask specific questions about their electrical system requirements. Inquire about their policies regarding older homes, what specific electrical components or systems might cause coverage problems, whether they require electrical inspections before binding coverage, and what upgrade requirements they might have for certain types of electrical systems.

Some insurance companies specialize in older homes and may be more flexible with electrical system requirements, while others have strict standards that could make coverage impossible without upgrades. Understanding these differences before closing allows you to shop for appropriate coverage or plan for necessary improvements.

Working Effectively with Insurance Companies

When you do find an insurance company willing to provide coverage, maintain open communication about your home’s electrical system. If you discover issues after closing, contact your insurance company immediately to discuss options. Some insurers will work with homeowners on upgrade timelines, particularly if you demonstrate commitment to addressing problems promptly.

Document any electrical work you complete with proper permits and professional installation. Insurance companies want to see that electrical improvements meet current codes and were completed by licensed professionals. Keep detailed records of all electrical upgrades, as these can not only maintain your current coverage but potentially reduce your premiums.

The Financial Reality of Electrical Upgrades

Understanding the potential costs of electrical upgrades helps you make informed decisions during the home buying process. Basic electrical panel upgrades typically range from $1,500 to $3,000, while whole-house rewiring can cost $8,000 to $15,000 or more, depending on the home’s size and complexity.

While these costs may seem substantial, they’re often negotiable during the purchase process and represent important safety improvements that protect your investment. Compare these upgrade costs to the financial risk of losing insurance coverage or facing electrical safety hazards in an unprotected home.

Building Your Home Buying Team

Protecting your investment requires assembling the right team of professionals. Beyond your real estate agent and general home inspector, consider including a licensed electrician for specialized electrical assessment, an insurance agent experienced with your area and home type, and potentially an electrical contractor who can provide upgrade estimates during your due diligence period.

This team approach ensures that electrical considerations are integrated into your buying decision from the beginning, rather than becoming an expensive surprise after closing.

Conclusion: Prevention is Your Best Protection

The case of my client who faced insurance cancellation after closing illustrates why proactive electrical assessment is crucial in today’s real estate market. By understanding insurance requirements, investing in specialized electrical inspections, and maintaining open communication with insurance providers, you can protect your home investment from costly surprises.

Remember that your home is likely your largest financial investment. Spending a few hundred dollars on a comprehensive electrical inspection during the buying process can save you thousands in post-closing problems and provide peace of mind that your investment is truly protected.

Don’t let electrical issues shock your wallet or jeopardize your homeownership dreams. Take control of the process, ask the right questions, and ensure that your electrical system meets both safety standards and insurance requirements from day one.

This article is for informational purposes only and should not be considered as professional electrical or insurance advice. Always consult with licensed professionals for specific guidance regarding your property and coverage needs.

Start Your Mortgage Application with Treasure Coast Home Loans

Your Local Mortgage Broker

Mortgage Broker Port St. Lucie, Florida

Learn More About the Mortgage Process.

Check Out Our Google Verified Reviews