Rents Are Rising Fast! 4x Over 2020. Here’s What You Can Do.

Imagine paying $1500/month for rent in 2021 and getting a renewal letter for $2079.

Original Source Mortgage News Daily

That's the reality for those living in the metropolitan area where rental prices are accelerating the fastest according to the Single-Family Rent Index (SFRI) released by CoreLogic.

While the 38.6% seen in Miami was by far the highest annual change, other metros were nonetheless well above 2020's levels. In fact, rental prices are now appreciating more than 4 times faster compared to 2020's average (12.6% vs 2.6% in 2020).

Keep in mind that the "4 times faster" comparison is a bit misleading because we're taking the very hottest month and comparing it to an average of 12 months. If we instead simply use the latest month of 2020 as a baseline, the thesis becomes something more like "rental price appreciation remains in double digit territory." Specifically, December's year-over-year change was 12.0% compared to January's 12.6%.

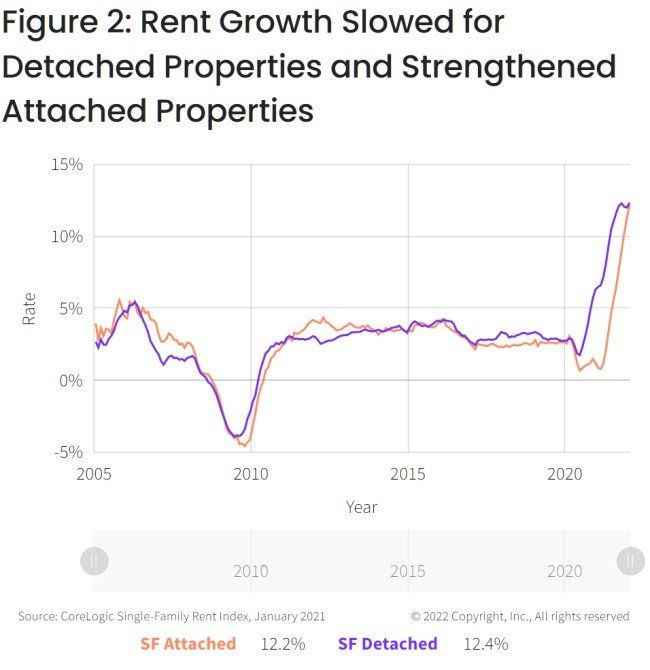

One notable shift over the past several months has been the ability of the "attached" home sector (condos/townhomes) to match the pace of the detached single family residence.

Rent price appreciation has been broad-based as well, with both low and mid tier homes at 12% and 12.2% respectively. Not pictured in the chart above, middle-priced tiers led the charge with both "lower-middle" (75%-100% of regional median) and "higher-middle" (100%-125% of regional median) coming in at 13.3% and 13.4% respectively.

CoreLogic will release additional data and charts for this report on April 19, 2022.

When you’re ready to start the pre-approval process, consider working with the local mortgage advisor your real estate agent refers you to. They have lots of options, more significant savings and your best interests in mind.

If you have any specific questions regarding the home loan pre-approval process, let me know. To check out all your loan options, our

services page.

“Here’s what to do now… download your free homebuyer ebook, click here.”

My name is Edgar DeJesus. I’m the mortgage advisor and branch manager of Treasure Coast Home Loans. Call or text,

(772) 444-6362, with any questions that will let me separate opinion from opportunity.

Thank you for taking the time to read my latest real estate and mortgage report.

Start Your Mortgage Application with Treasure Coast Home Loans

Your Local Mortgage Broker

Mortgage Broker Port St. Lucie, Florida

Learn More About the Mortgage Process.

Check Out Our Google Verified Reviews